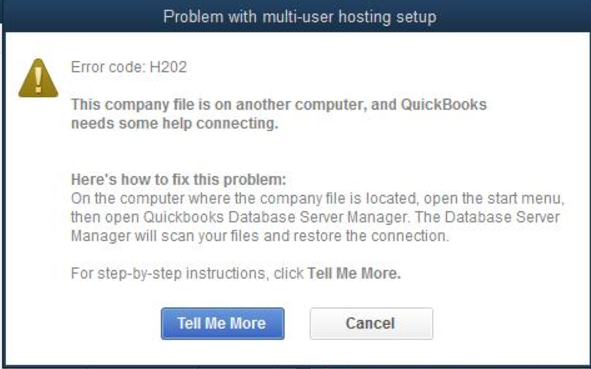

How to fix QuickBooks Desktop Error H202

If you see Error H202 when you try to switch to multi-user mode, we’re here to help. These errors mean something is blocking the multi-user connection to your server. We'll show you how to fix the issue. Step 1: Follow steps depending on how you host your company files Hosting your own network If you haven’t already, follow the steps to install QuickBooks Database Server Manager on your server for each version of QuickBooks you use. Your server is the computer that hosts your company files . After you install Database Server Manager, continue below. There are two ways to set up QuickBooks Database Server Manager: The Full Program option: You install the full version of QuickBooks Desktop and Database Server Manager on your server computer. The Server Only option: You only install Database Server Manager on your server computer. Hosting your own network with Windows Server 2012 Essentials R2 Follow these steps if you use Windows Server 2012 Essentials ...