Individual Income Tax Return

What is Individual Income Tax Return ?

First of all we understand the what is Individual ? so we can go ahead.

The Individual means any natural human being whether it's Male or Female are knows as the Individual according to the Income Tax.

So now we can move to our main topic "Individual Tax Return".

The Individual Income Tax or Personal Income tax which is levied on generally on the wages, salaries, interest, dividends or any other types of income which earns during the year. The Federal Income Tax was established in 1913 with the 16th amendment. Form the last 100 Years, Individual Income Taxes are the largest source of tax revenue in the county. Individual income tax are levied by the Federal Government (Central), State Government or Local. Most of the countries in the world levy the Individual Income Tax Return. In US Income tax is progressive, which means if the income of a person rises then the tax will also rise and vice-a- versa.

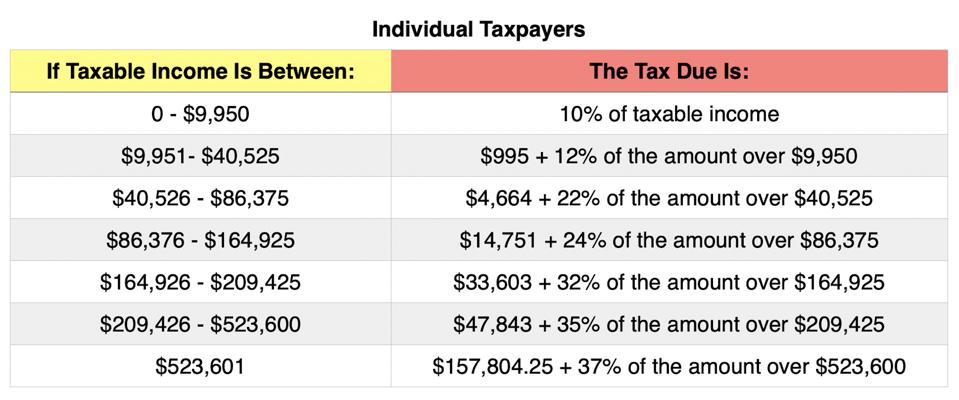

There some some federal income tax brackets which incudes the rates of taxes which depend upon the income of the only individual. Tax rates are 10%, 12%, 22%, 24% ,32%, 35%, 37%. There rates may changed according to the income of the individuals. In the country there are some state which is not provide any standard deduction. While computing the Individual Income tax we have to calculate the deductions, credits and all taxable income.

You can file Individual income tax return by online(Electronic) or offline (Hard copy of tax return), otherwise you can take help from your accountant or tax advisor. If you have paid excess taxes in that financial year then the IRS give the excess amount which you paid at time income tax filling.

Tax is the most important sources of Government revenue, which helps for the development of the country. The government have collected the 50% of his tax revenue by Individual Income Tax, 7% from the Corporate Income Tax, 36% form Social Insurance Tax (Payroll Tax), 3% from the Excise tax and only 5% form the others sources. In other sources have included estate and gift taxes, custom duties, and some service fees or charges.

The totally federal government collected revenues of $3.5 trillion n 2019, which is equal to 16.3% of GDP(Gross Domestic Product).

Comments

Post a Comment