Best Accounting Software for Your Business

There are many different types of accounting software available for small businesses, with varying capabilities and price tags. Generally, the type of industry and number of employees are two factors that can help a small business owner begin to choose the accounting software that is appropriate. For example, a freelancer would not need the same features in accounting software as a restaurant owner.

In market there are many types of software available for varieties of industries. We have searched around 10-12 accounting software are available, but some software are very helpful for any types of businesses. While evaluating the best accounting software we considered the uses, features, reliability and cost.

There are some best Accounting Software :-

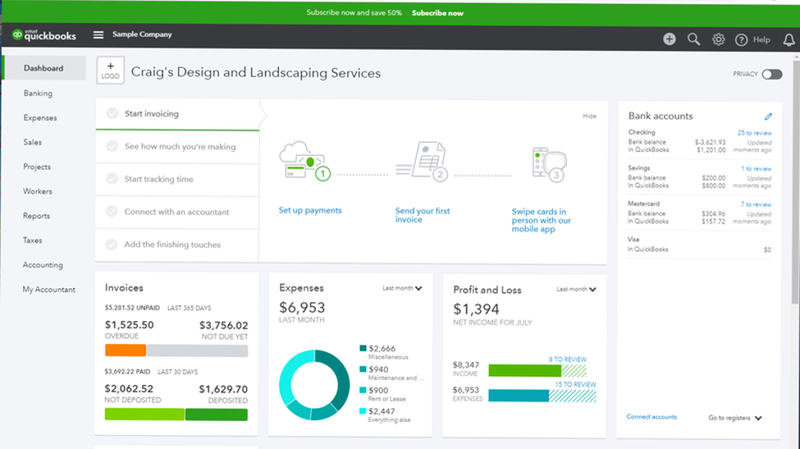

1. QuickBooks Desktop or Online: QuickBooks Desktop or Online is the best overall accounting software for small businesses of those reviewed. Not only do the majority of small business or other types of accounting professionals use QuickBooks Desktop or Online, but there are also endless online training resources and forums to get support when needed. All accounting features can be conveniently accessed on one main dashboard, making bookkeeping more fluid and efficient.

Intuit’s QuickBooks Desktop or Online has been the most common accounting software used by small businesses and their bookkeeping and tax professionals. The software is cloud-based and can be accessed through a web browser or through the mobile app. They provide you 30 days free trail after that they charge according to their plans.

as a business grows, and there are many customization options with the mobile app that can be used to receive payments, review reports, capture an image of a receipt, and track business mileage. For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Desktop or Online.

2. XERO: Xero is the best in our review for micro-businesses that are looking for very simple accounting software. This software has a clean interface and also fully integrates with a third-party payroll service. Businesses can collect payment online from customers through Xero’s integration with Stripe and GoCardless.

Xero was founded in 2006 in New Zealand and now has over two million users worldwide. This accounting software is popular in New Zealand, Australia, and the United Kingdom. Xero has over 3,000 employees and is growing rapidly in the U.S., as well. Xero offers 3 monthly subscriptions like., Early, Growing & Established according to your businesses. They are also providing the 30 days free trail.

The Early plan limits usage and only allows entry for five invoices or quotes, five bills, and reconciliation of 20 bank transactions per month. Both the Growing and Established plans offer unlimited invoices, bills, and transactions. The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. All three plans offer Hubdoc, a bill and receipt capture solution.

3. FreshBooks: The most crucial accounting need for most service-based businesses is invoicing. FreshBooks offers more customizations for invoicing compared to other accounting software. Its primary function is to send, receive, print, and pay invoices, but it can also take care of a business’ basic bookkeeping needs as well. This accounting software makes it easier for service-based businesses to send proposals and invoices, request deposits, collect client retainers, track time on projects, and receive payments.

FreshBooks started as just an invoicing software, but after that over time, more features have been added. FreshBooks have four plans are: Lite at $6 per month, Plus at $10 per month, Premium at $20 per month, and Select, which is a custom service with custom pricing.

4. Wave: Wave is an ideal accounting software platform for a service-based small business that sends simple invoices and doesn’t need to track inventory or run payroll. For many freelancers or service-based businesses, Wave’s free features will cover all of their accounting needs and is the best free software in our review. At year-end, accountants can pull the necessary reports from Wave to prepare a business’ tax return.

The foundational accounting features that most small businesses need, such as income and expense tracking, financial reporting, invoicing, and scanning receipts, are all included with this free software. These features can be accessed online or on the mobile app. Customer payment processing and payroll are considered premium services that cost extra, but all of the bookkeeping, invoicing, and reporting features are completely free.

FAQ

1. What does accounting software do for your business ?

Accounting software reduces the amount of time spent on data entry by allowing users to sync their business bank accounts and credit cards with the software. Once synced, transactions will flow into the accounting software, where they can be categorized into various accounts. While most accounting software is easy to use, a general understanding of accounting principles is needed to ensure that financial reports are prepared correctly. For this reason, many businesses hire bookkeepers or accountants to maintain or review their books.

The most basic functions of accounting software for small business are:

- Invoicing

- Bank and credit card syncing

- Accounts payable

- Accounts receivable

- Online payment collection from customers

- Basic financial statement preparation, such as profit and loss statements, balance sheets, and statements of cash flow

- User access for accountants or tax professionals.

Comments

Post a Comment