What Is Petty Cash?

What is petty cash ?

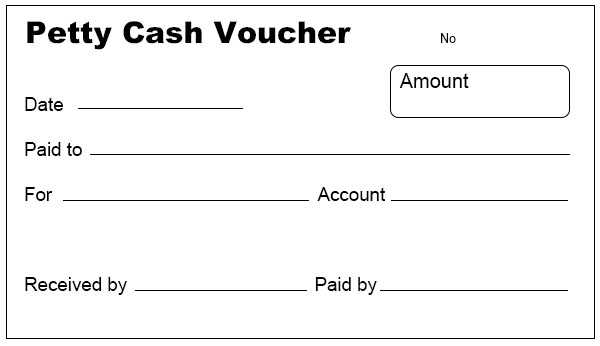

A petty cash fund is a small amount of cash kept on hand, in a locked drawer or box, to pay for minor expenses, such as office supplies or reimbursements. A petty cash fund will undergo periodic reconciliations, with transactions also recorded on the financial statements. In larger corporations, each department might have its own petty cash fund.

(Images sources from : https://workful.com/blog/wp-content/uploads/2018/04/what-is-petty-cash.png)

Use of Petty Cash

Petty cash transactions provide convenience for small transactions for which issuing a check or a corporate credit card is unreasonable or unacceptable. The small amount of cash that a company considers petty will vary, with many companies keeping between $100 and $500 as a petty cash fund. Examples of transactions that a petty cash fund is used for include:

- Office supplies.

- Cards for customers.

- Flowers.

- Paying for a catered lunch for a small group of employees.

- Reimbursing an employee for small work-related expenses.

Requirements for Petty Cash

The use of a petty cash fund can circumvent certain internal controls. However, the availability of petty cash does not mean that it can be accessed for any purpose and by anyone. Many companies employ strict internal controls to manage the fund. Often, limited individuals are authorized to approve disbursements and can only do so for expenses related to legitimate company activities or operations.

A petty cashier might be assigned to issue the check to fund the petty cash drawer and make the appropriate accounting entries. The petty cash custodian is charged with distributing the cash and collecting receipts for all purchases or any uses of the funds. As the petty cash total declines, the receipts should increase and add up to the total amount withdrawn.

By having a petty cash cashier and a petty cash custodian, the dual-process helps to keep the funds secure and ensure that only those authorized have access to it.

Recording Petty Cash

When a petty cash fund is in use, petty cash transactions are still recorded on financial statements. No accounting journal entries are made when purchases are made using petty cash, it’s only when the custodian needs more cash—and in exchange for the receipts, receives new funds—that the journal entries are recorded. The journal entry for giving the custodian more cash is a debit to the petty cash fund and a credit to cash.

If there's a shortage or overage, a journal line entry is recorded to an over/short account. If the petty cash fund is over, a credit is entered to represent a gain. If the petty cash fund is short, a debit is entered to represent a loss. The over or short account is used to force-balance the fund upon reconciliation.

Petty Cash vs. Cash on Hand

"Petty cash" and "cash on hand" sound a lot alike, and they do overlap. Of the two, "cash on hand" is the more generic term.

Petty cash refers specifically to money—literally, coins and bills—that a company keeps on hand for small outlays, usually because it's simpler and more convenient /practical than using a check or credit card.

Cash on hand is any accessible cash the business or liquid funds have. It can be in the form of actual money, like amounts you haven't yet deposited in the bank or smaller bills and coins that you keep in the cash register to make change for customers. In this meaning, the difference from petty cash refers to where you're keeping the money, and how you're using it—with petty cash being more for internal business needs/expenses by employees, and cash in hand referring to funds received from or being reimbursed to customers.

But cash on hand has a larger meaning, as an accounting term. In the financial world, it also refers to a company's highly liquid assets—funds in checking or other bank accounts, money market funds, short-term debt instruments, or other cash equivalents. Though not literally cash, it's money that can be easily and quickly accessed, which is why it's "on hand."

In short: All petty cash is a form of cash on hand, but not cash on hand is petty cash.

(Article source from : https://www.investopedia.com/terms/p/pettycash.asp)

For any types CPA assistance you can contact us @ www.cpacb.com

Comments

Post a Comment