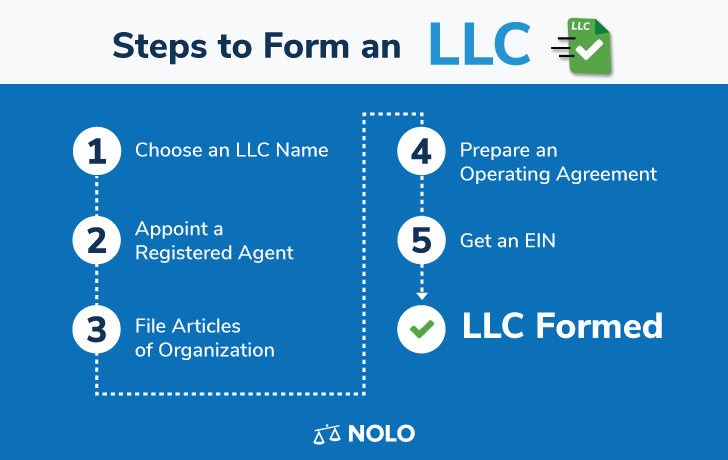

How to Form an LLC in Texas

Here are the steps you need to take to form a limited liability company (LLC) in Texas. For more information on how to form an LLC in any state, see the below article How to Form an LLC.

1. Choose an LLC Name

Under Texas law, an LLC name must contain the words the words "Limited Liability Company" or "Limited Company," or the abbreviations "L.L.C.," "LLC," "LC," or "L.C." "Limited" may be abbreviated as "Ltd." or "LTD" and "Company" as "Co."

Your LLC's name must be distinguishable from the names of other business entities already on file with the Texas Secretary of State. Names may be checked for availability at the Texas Secretary of State SOSDirect website.

You may reserve a name for 120 days by filing a Application for Reservation or Renewal of Reservation of an Entity Name (Form 501) with the Texas Secretary of State. The reservation may be filed online through the Texas Secretary of State SOSDirect website, or filed by mail. The filing fee is $40.

2. Appoint a Registered Agent

Every Texas LLC must have an agent for service of process in the state. This is an individual or business entity that agrees to accept legal papers on the LLC's behalf if it is sued. The registered agent may be a Texas resident or a business entity authorized to do business in Texas. The registered agent must have a physical street address in Texas. The LLC may not be its own registered agent. You can find information on Texas commercial registered agents here.

3. File a Certificate of Formation

A Texas LLC is created by filing a Certificate of Formation for a Limited Liability Company (Form 205) with the Secretary of State. The certificate must include:

- the LLC's name, including the chosen LLC designation

- the name and address of the LLC's registered agent

- whether the LLC will be member-managed or manager-managed

- if member-managed, the name and address of each initial member

- if a manager-managed, the name and address of each initial manager

- general purpose clause (as provided)

- the name and address of the LLC's organizer

- the effective date of the certificate, and

- signature of the organizer.

The certificate may be filed online through the Texas Secretary of State SOSDirect website, or by mail. The filing fee is $300.

4. Prepare an Operating Agreement

An LLC operating agreement is not required in Texas, but is highly advisable. This is an internal document that establishes how your LLC will be run. It is not filed with the state. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed. It can help preserve your limited liability by showing that your LLC is truly a separate business entity. In the absence of an operating agreement, state LLC law will govern how your LLC operates.

The operating agreement should include the following:

- the members' percentage interests in the LLC

- the members' rights and responsibilities

- the members' voting powers

- how profits and losses will be allocated

- rules for holding meetings and taking votes, and

- buyout, or buy-sell, provisions, which determine what happens when a member wants to sell his or her interest, dies, or becomes disabled.

All of the paperwork and procedural steps to start a limited liability company can be done by contacting us for an LLC Formation service.

5. Obtain an EIN

If your LLC has more than one member, it must obtain its own IRS Employer Identification Number (EIN), even if it has no employees. If you form a one-member LLC, you must obtain an EIN for it only if it will have employees or you elect to have it taxed as a corporation instead of a sole proprietorship (disregarded entity). You may obtain an EIN by completing an online EIN application on the IRS website. There is no filing fee.

6. Annual Reports

Unlike most states, Texas does not require LLCs to file annual reports with the Secretary of State. However, LLCs must file annual franchise tax reports. The details for computing the tax can be complicated. Check the Comptroller of Public Accounts website for more information.

(Article source from: https://www.nolo.com/legal-encyclopedia/texas-form-llc-31745.html)

If you need any types of CPA assistance please visit us @ www.cpacb.com

Comments

Post a Comment