What is Form W-2?

The IRS requires employers to report wage and salary information for employees on Form W-2. Your W-2 also reports important details about the amount of federal, state and other taxes withheld from your paycheck as well as other employer fringe benefits like health insurance, adoption and dependent care assistance, health savings account contributions and more. As an employee, the information on your W-2 is extremely important when preparing your tax return.

In general, if you worked as an employee in a given year, you should receive a W-2 from your employer near the beginning of the following year. You will also receive a W-2 if your employer withheld any taxes from your paycheck.

Key Takeaways

- Form W-2 provides important tax information from your employer related to earnings, tax withholding, benefits and more

- Your Form W-2 should be sent by January 31st of each year and be used to prepare your tax return

- The IRS uses W-2s to track employment income you’ve earned during the prior year

When are W-2s due in 2022?

To ensure you have it in time, the IRS requires your employer to send you a W-2 no later than January 31st following the close of the tax year. Generally, this means W-2s are mailed by January 31st, but not necessarily received by employees by this date.

As an employer, you must file W-2 forms with the Social Security Administration (SSA) and the IRS by January 31st but may file for a 30-day extension by submitting Form 8809, Application for Extension of Time to File Information Returns. You will need to indicate that at least one of the criteria for granting an extension applies.

Even if you request and receive an extension to file W-2s with the Social Security Administration and IRS, you must still provide your employees copies of their W-2s by January 31st unless you also apply for an extension to provide W-2s to your employees after the due date.

You can request an extension of 15 days to provide W-2s to your employees unless you show a need for a 30-day extension by faxing a letter to the IRS.

What to do if you haven’t received your W-2

If you haven’t received your W-2 by early February, contact your employer. They might be able to provide you with an electronic version for use until you receive the paper version in the mail.

TurboTax Tip: You can also use online tax software like TurboTax to import your W-2 even if you haven’t received it in the mail yet.

What to do if you find an error on your W-2

If you receive your W-2 and notice an error on your form, whether your name is misspelled, has an incorrect social security number, wrong dollar amount, or some other issue, let your employer know and ask for a corrected W-2.

Who receives a Form W-2?

You should only receive a W-2 if you are an employee.

TurboTax Tip: If you are an independent contractor or work for yourself, the work you do may be similar to what an employee does, but you should receive an earnings statement on a Form 1099-NEC rather than a W-2.

You may also receive multiple W-2s if you:

- changed jobs within the calendar year, or

- work more than one job where you’re considered an employee, or

- the company you worked for was acquired by another company

How do you use a W-2?

Form W-2 is completed by an employer and contains important information that you need to complete your tax return. It reports your total wages for the year and the amount of federal, state, and other taxes withheld from your paycheck. It may also contain information about:

- Tips

- Contributions to a 401(k)

- Contributions to a health savings account

- Premiums your employer pays for health coverage

- A variety of other information

How to read Form W-2

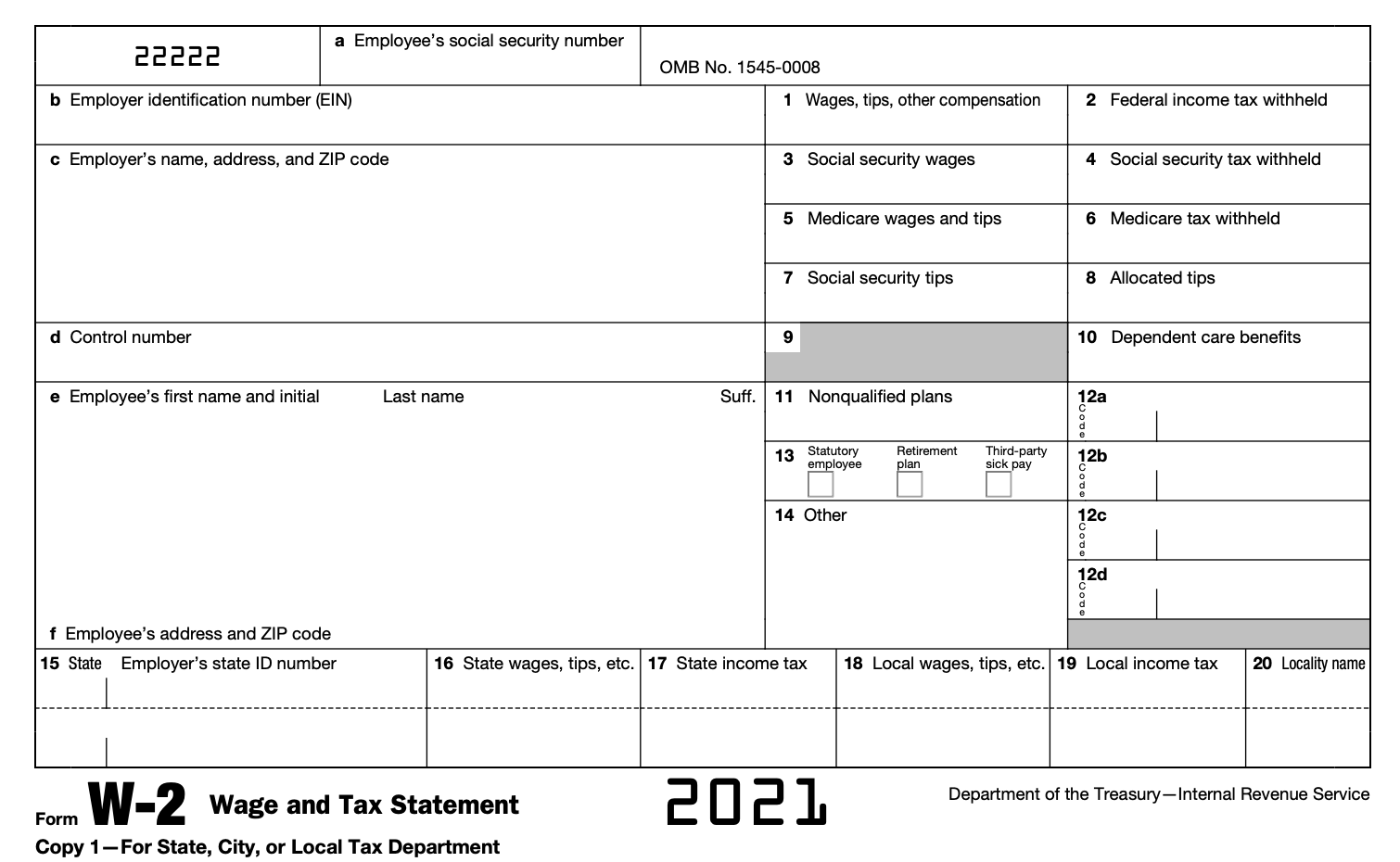

Boxes A-F

These boxes on the W-2 provide all the identifying information related to you and your employer. You’ll see your social security number (Box A), name (Box E) and address (Box F) appear here, while your employer’s employer identification number (EIN) (Box B), name and address (Box C) and control number, if any, (Box D) appear here as well.

Boxes 1 and 2

Box 1 shows your total taxable income paid by your employer including any and all wages, salary, tips, bonuses and other taxable compensation. Box 2 shows the total amount of federal income tax withheld by your employer on your behalf.

Boxes 3-6

Boxes 3 and 5 show the amount of your earnings subject to Social Security and Medicare taxes, respectively. Boxes 4 and 6 show the amount of Social Security and Medicare taxes withheld. The amounts in boxes 3 and 5 might be different from the amount in box 1. This often happens in situations where you defer income as with contributing to a 401(k) or other similar plan.

Boxes 7 and 8

If you earned money through tips, Box 7 shows how much has been reported in tips while Box 8 shows how much money your employer allocated to you in tips.

Box 9

The box once reported an employer benefit which no longer exists. The box is grayed out as a result.

Box 10

If your employer provided or paid for dependent care benefits, Box 10 reports this amount.

Box 11

If you received certain deferred compensation income from your employer from a non-qualified plan, this information is reported in Box 11.

Box 12

If you received other types of compensation or reductions to your taxable income, these will be reported in the Box 12 series. You will have a single or double letter code corresponding to each, including items such as contributions made to a 401(k) plan, health savings account contributions made by your employer, or the taxable cost of group-term life insurance over $50,000.

Box 13

Box 13 reports whether you worked as a statutory employee not subject to federal income tax withholding, participated in an employer-sponsored retirement plan such as a 401(k) or 403(b), or received sick pay through a third-party source, like an insurance policy.

Box 14

If you have other tax information that doesn’t fit into the other W-2 Boxes, your employer may use Box 14 to report these items. Such examples include state disability insurance taxes withheld, union dues, uniform payments, health insurance premiums deducted and more.

Boxes 15-20

Your employer uses Boxes 15-20 to report state and local income tax information with the two-letter abbreviation for the name of your state alongside your employer’s state ID number assigned by the state. These boxes can report wages for two states and two localities and are broken up and separated by the broken line.

If your employer needs to report information for more than two states or localities, they need to prepare a second Form W-2 for you to use.

What is the difference between a 1099 and W-2?

Both the Form W-2 and Form 1099 are meant to report income you earned from sources throughout the tax year. Where they differ are the circumstances under which you’d receive them and the approaches for tax season planning.

When you work as an employee, your employer should send you a W-2 to complete your tax return, Form 1040. If you work as an independent contractor, the company will likely send you Form 1099-NEC rather than a W-2.

The difference between a 1099 and W-2 primarily comes down to the tax withholdings. Employers (W-2) withhold money from your pay and send it to the various tax agencies throughout the tax year on your behalf.

As a self-employed person (1099), the business paying you doesn’t usually withhold money on your behalf. You are responsible for making your own estimated tax payments.

What is the difference between a W-4 form and W-2 form?

While similar in name, there are big differences between a W-4 form and W-2 form.

First, who prepares each form differs. If you work as an employee, you prepare a W-4 form and submit it to your employer. Your employer prepares a W-2 at the end of the year and submits it to you as well as the IRS and Social Security Administration.

Second, the W-4 tells your employer how much tax to withhold from your paycheck. The W-2 reports how much you earned from your employer as well as how much tax was withheld on your behalf during the tax year.

You should consider reviewing your tax withholding annually to ensure you withhold the correct amount of money from your paychecks. If you receive a large refund each year and would rather have a bigger paycheck each pay period, you can use the W-4 to instruct your employer to change your withholding.

Likewise, if you underpaid your taxes and owed a balance to the IRS, you can provide a new W-4 to your employer so they will withhold more from each paycheck. This can help you avoid cutting a check to the IRS each year.

To get a better sense of how much you might need to withhold, use TurboTax’s W-4 withholding calculator.

Verifying your name and Social Security number

The identifying information section of the W-2 is essentially a tracking feature. If the income you report on your taxes does not match the information on all of your W-2s, the IRS will want to know why. Similarly, the IRS will match the reported payment amounts with your employer's corporate tax reporting for accuracy.

But most importantly, since the IRS receives a copy of your W-2s, it already knows that you likely have reportable income and may contact you if you fail to file a tax return. If the name or Social Security number on your W-2 is inaccurate, you should immediately report this to your employer to correct.

(Article source from: https://turbotax.intuit.com/tax-tips/irs-tax-forms/what-is-a-w-2-form/L6VJbqWl5)

If you need any types of CPA assistance please visit us @ www.cpacb.com

Comments

Post a Comment